Quantera's EDGAR Integration

13 feb 2026

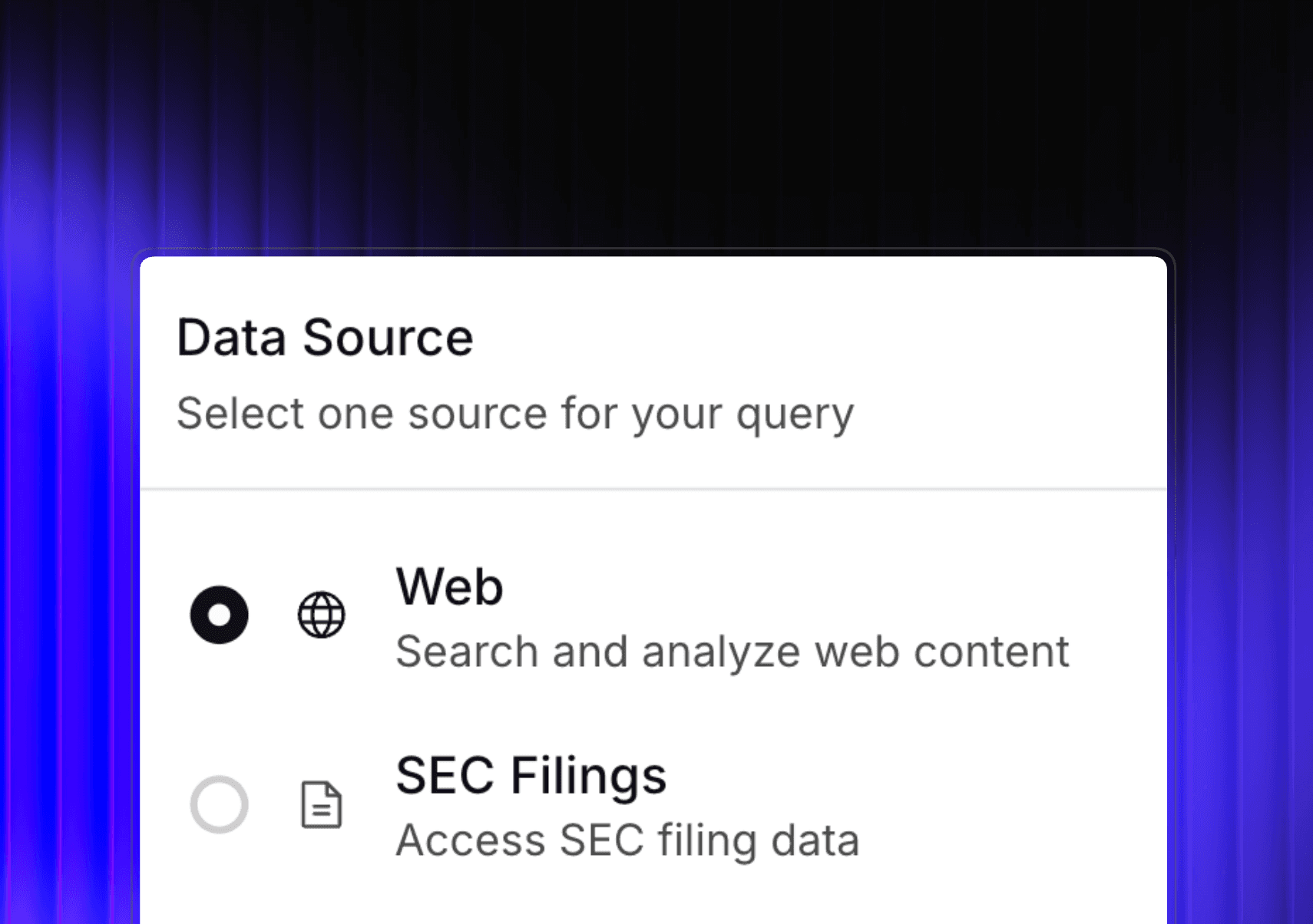

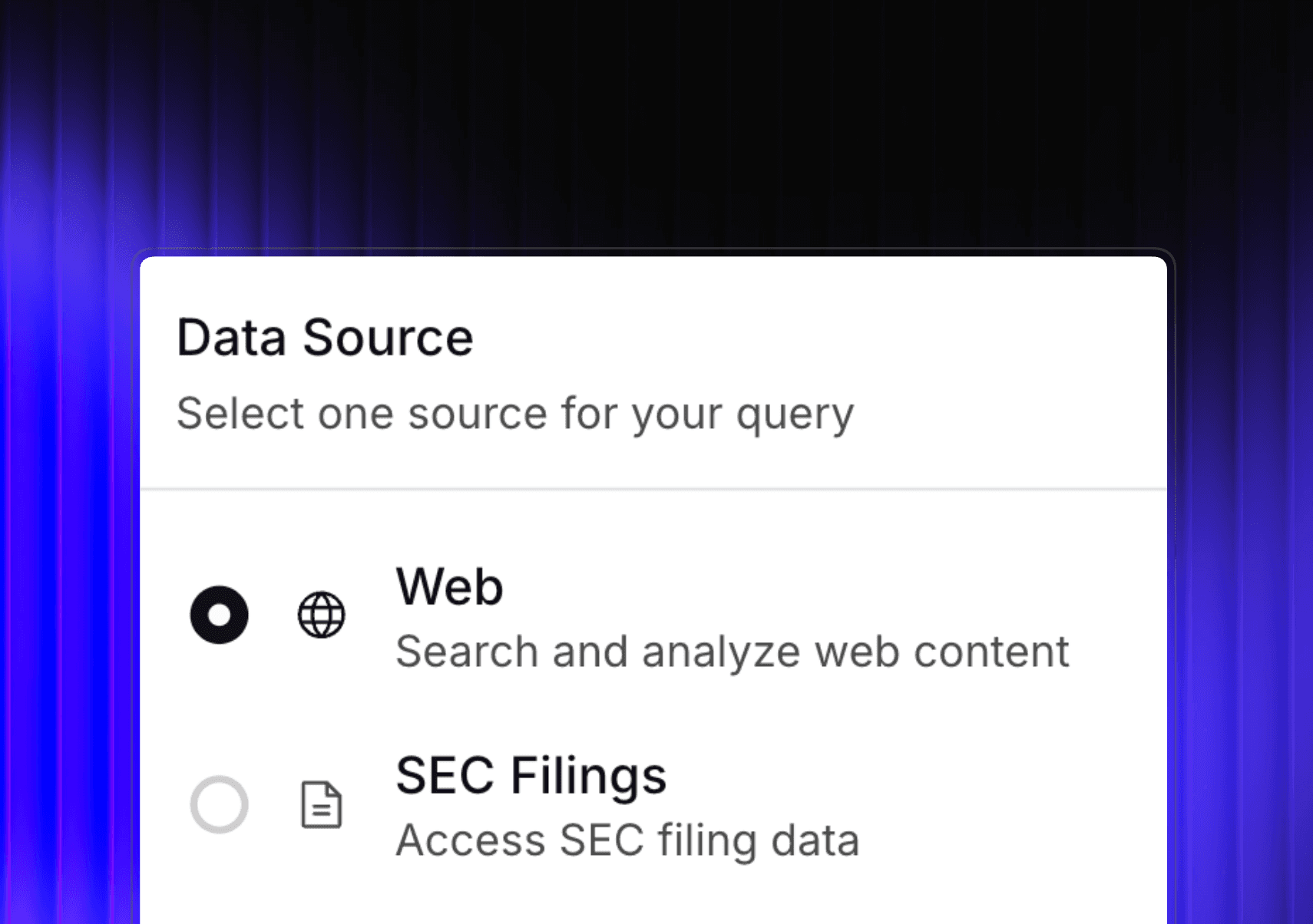

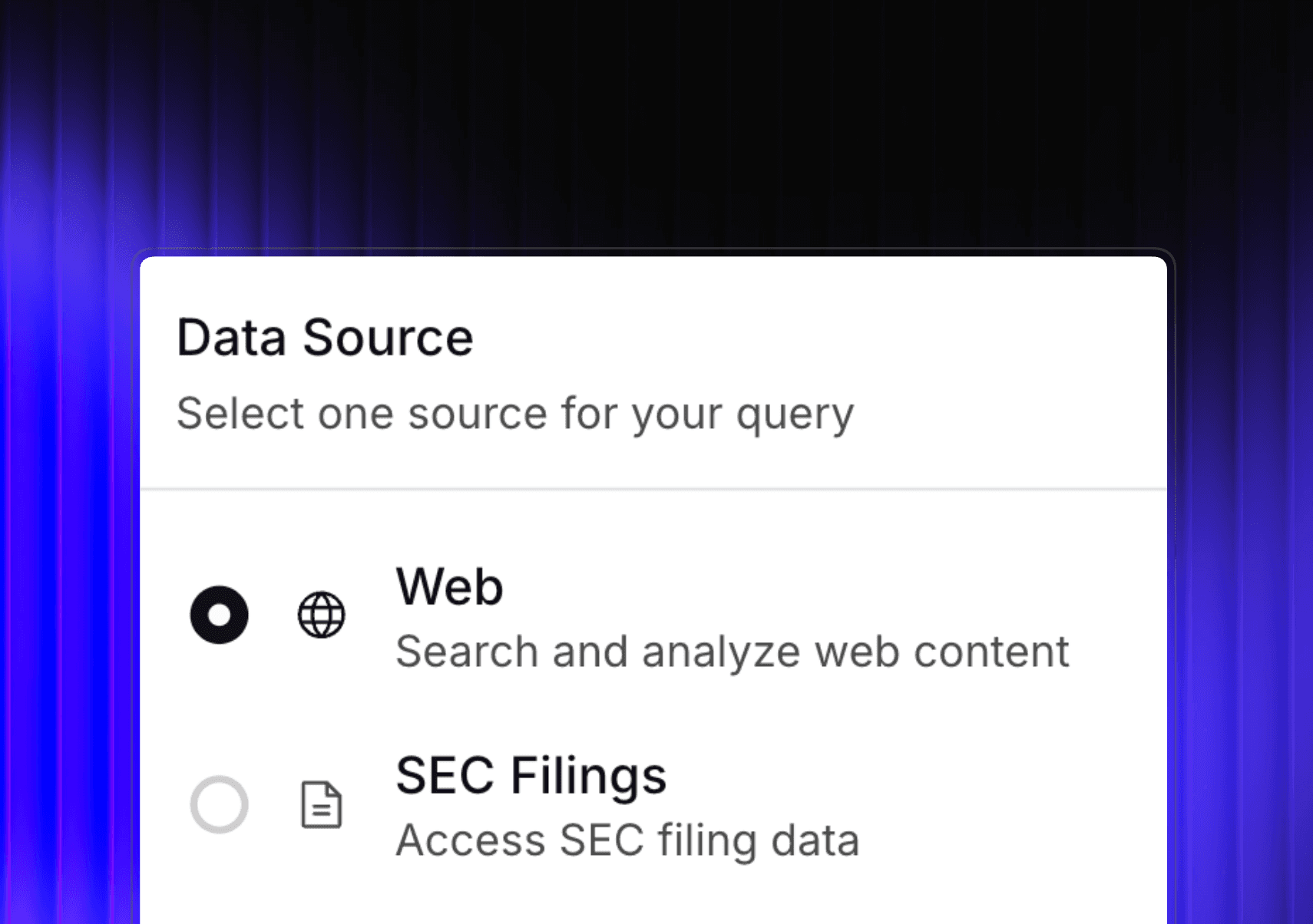

Unlocking one of the world’s most critical financial dataset for our AI Agents. At Quantera.ai, we believe that the power of an AI agent is effectively limited by the quality of the data it can access. While reasoning models (like those we discussed in our Agents in Production post) are the engine, data is the fuel. Today, we are thrilled to announce a major expansion of our Knowledge Graph: Full integration with the SEC’s EDGAR database.

Starting today, Quantera agents have direct, real-time access to millions of corporate filings including 10-Ks, 10-Qs, 8-Ks, and Proxies. Grounding your answers in trusted data. This integration transforms Quantera from a tool that simply knows general information into a platform that can perform rigorous, fact-based analysis on the definitive source of truth for US public markets.

Why EDGAR Matters for Quantera Users

For professionals in legal, private equity, strategy, and compliance, SEC filings are not just documents; they are the bedrock of due diligence. By integrating EDGAR directly into Quantera.ai, we are solving the "last mile" problem of financial research: the time spent finding, parsing, and comparing data.

Our agents don’t just "search" EDGAR; they read and reason over it.

Powering Specific Use Cases

With this integration, Quantera.ai agents can now execute complex workflows that previously took analysts hours to compile:

Automated Due Diligence: Instantly compare "Risk Factors" sections across five years of 10-K filings to identify subtle shifts in a company's disclosure language.

Financial Extraction: Instruct an agent to "Extract revenue tables from the last 8 quarters of [Company X] and [Company Y] and format them into a comparative CSV."

Event Tracking: Set up agents to monitor 8-K filings for specific triggers—such as executive changes or material litigation—and generate an immediate summary memo.

Market Intelligence: Query across an entire sector. (e.g., "Based on recent 10-Qs, summarize the exposure of the semiconductor industry to supply chain disruptions in Southeast Asia.")

Grounding AI in Truth

One of the biggest challenges in Enterprise AI is accuracy. By anchoring our agents to the EDGAR database, Quantera.ai significantly reduces the risk of hallucinations. When you ask a question about a company’s financials, the agent cites the specific filing, page, and row where the data resides.

This provides the audit trail that high-stakes knowledge work demands.

Get Started

The EDGAR integration is now live for all Enterprise users. Experience the future of automated financial research and see how Quantera.ai is turning public records into proprietary advantages.

Starting today, Quantera agents have direct, real-time access to millions of corporate filings including 10-Ks, 10-Qs, 8-Ks, and Proxies. Grounding your answers in trusted data. This integration transforms Quantera from a tool that simply knows general information into a platform that can perform rigorous, fact-based analysis on the definitive source of truth for US public markets.

Why EDGAR Matters for Quantera Users

For professionals in legal, private equity, strategy, and compliance, SEC filings are not just documents; they are the bedrock of due diligence. By integrating EDGAR directly into Quantera.ai, we are solving the "last mile" problem of financial research: the time spent finding, parsing, and comparing data.

Our agents don’t just "search" EDGAR; they read and reason over it.

Powering Specific Use Cases

With this integration, Quantera.ai agents can now execute complex workflows that previously took analysts hours to compile:

Automated Due Diligence: Instantly compare "Risk Factors" sections across five years of 10-K filings to identify subtle shifts in a company's disclosure language.

Financial Extraction: Instruct an agent to "Extract revenue tables from the last 8 quarters of [Company X] and [Company Y] and format them into a comparative CSV."

Event Tracking: Set up agents to monitor 8-K filings for specific triggers—such as executive changes or material litigation—and generate an immediate summary memo.

Market Intelligence: Query across an entire sector. (e.g., "Based on recent 10-Qs, summarize the exposure of the semiconductor industry to supply chain disruptions in Southeast Asia.")

Grounding AI in Truth

One of the biggest challenges in Enterprise AI is accuracy. By anchoring our agents to the EDGAR database, Quantera.ai significantly reduces the risk of hallucinations. When you ask a question about a company’s financials, the agent cites the specific filing, page, and row where the data resides.

This provides the audit trail that high-stakes knowledge work demands.

Get Started

The EDGAR integration is now live for all Enterprise users. Experience the future of automated financial research and see how Quantera.ai is turning public records into proprietary advantages.

Starting today, Quantera agents have direct, real-time access to millions of corporate filings including 10-Ks, 10-Qs, 8-Ks, and Proxies. Grounding your answers in trusted data. This integration transforms Quantera from a tool that simply knows general information into a platform that can perform rigorous, fact-based analysis on the definitive source of truth for US public markets.

Why EDGAR Matters for Quantera Users

For professionals in legal, private equity, strategy, and compliance, SEC filings are not just documents; they are the bedrock of due diligence. By integrating EDGAR directly into Quantera.ai, we are solving the "last mile" problem of financial research: the time spent finding, parsing, and comparing data.

Our agents don’t just "search" EDGAR; they read and reason over it.

Powering Specific Use Cases

With this integration, Quantera.ai agents can now execute complex workflows that previously took analysts hours to compile:

Automated Due Diligence: Instantly compare "Risk Factors" sections across five years of 10-K filings to identify subtle shifts in a company's disclosure language.

Financial Extraction: Instruct an agent to "Extract revenue tables from the last 8 quarters of [Company X] and [Company Y] and format them into a comparative CSV."

Event Tracking: Set up agents to monitor 8-K filings for specific triggers—such as executive changes or material litigation—and generate an immediate summary memo.

Market Intelligence: Query across an entire sector. (e.g., "Based on recent 10-Qs, summarize the exposure of the semiconductor industry to supply chain disruptions in Southeast Asia.")

Grounding AI in Truth

One of the biggest challenges in Enterprise AI is accuracy. By anchoring our agents to the EDGAR database, Quantera.ai significantly reduces the risk of hallucinations. When you ask a question about a company’s financials, the agent cites the specific filing, page, and row where the data resides.

This provides the audit trail that high-stakes knowledge work demands.

Get Started

The EDGAR integration is now live for all Enterprise users. Experience the future of automated financial research and see how Quantera.ai is turning public records into proprietary advantages.

Ready to see what we have built?

Join thousands of investors and professionals and see how we have driven their success.

Ready to see what we have built?

Join thousands of investors and professionals and see how we have driven their success.